/Client Story

Westpac Pay

Contactless payments for Android users.

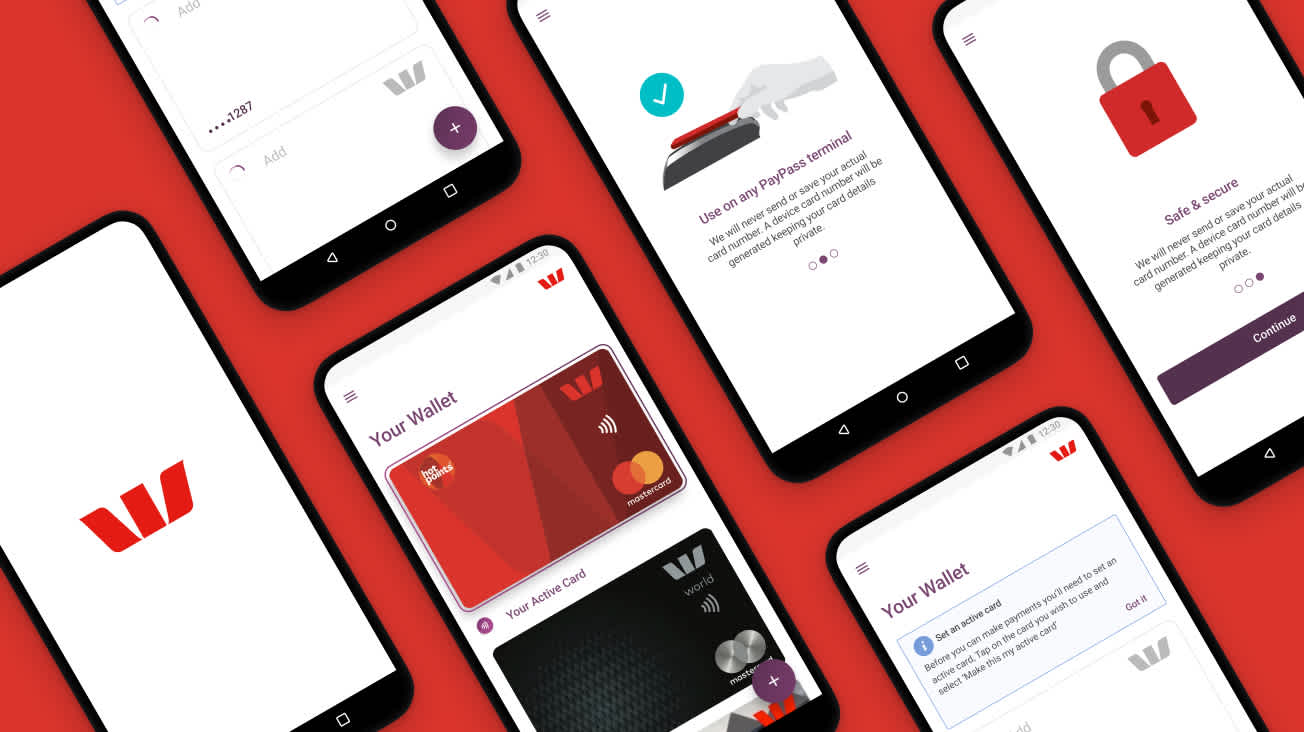

A secure, contactless digital payment experience.

- 01Conducted product workshops to help redefine the user journey

- 02Designed a mobile payment experience with 3 levels of security

- 03Ensured that the experience would comply with regulatory specifications and work within the client’s existing technical infrastructure

Client

Westpac New ZealandIndustry

The Challenge

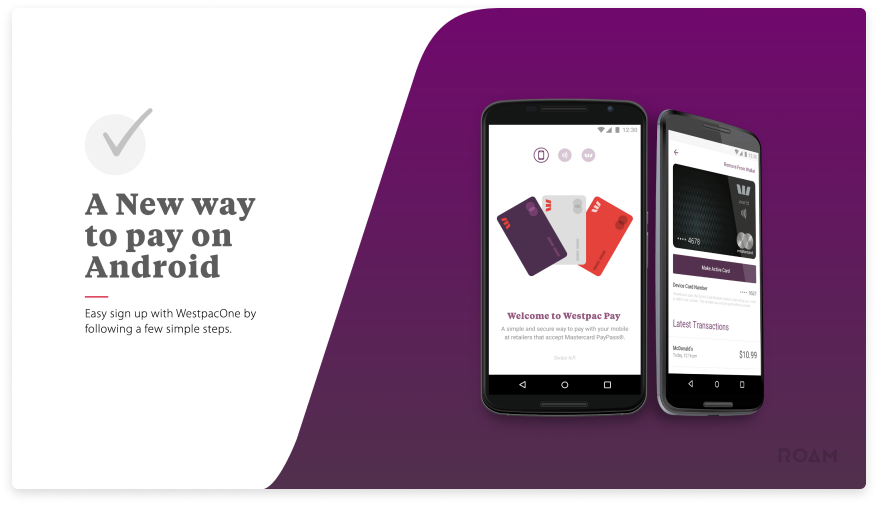

Westpac is one of New Zealand’s largest banks. They asked us to partner with them and Mastercard to deliver a seamless, contactless payment experience for their Android customers. The mobile app would mean banking could fit into customers’ lives, not the other way around: easy, convenient and secure payments on the move that would eventually replace a customer’s physical wallet.

The Solution

Building a mobile wallet for payments with contactless terminals is a technically complex undertaking. We needed to understand how our solution was going to work within the existing payments landscape in New Zealand, with all of its different banks, merchant terminals and the technical infrastructure in between.

Mastercard provided us with in-depth technical documentation, which gave us a starting point to build on through discussions with the Mastercard and Westpac teams. A series of product workshops helped us define the complete user journey, including the services, technical systems and integrations that would be involved.

This eventually led us to a proposed technical solution: a Westpac branded Android app using the Mastercard SDK, connected to Westpac for user authentication and payment transactions. Development was split into two key areas: the Mastercard SDK and front-end. Understanding the Mastercard SDK was critical to working with Westpac while developing backend APIs.

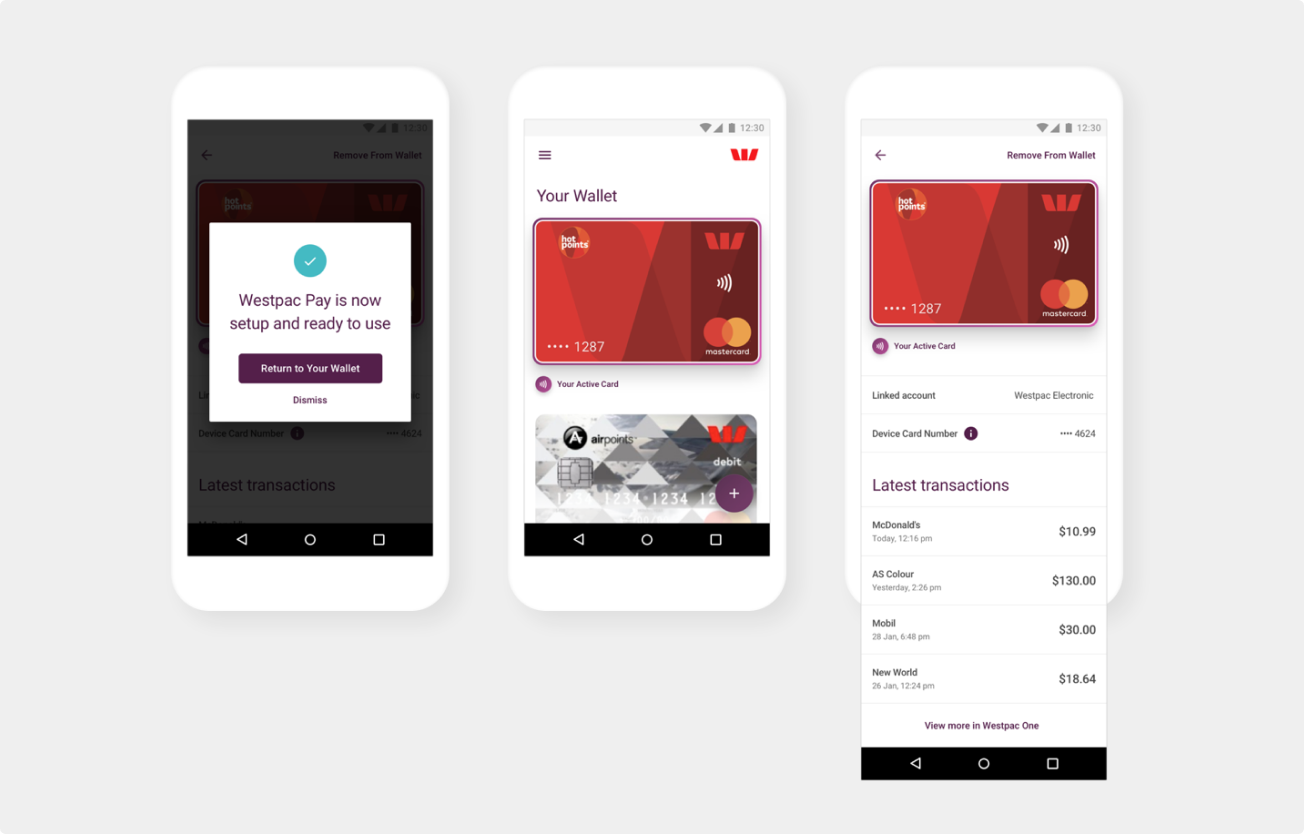

We knew the experience had to feel secure, be simple to use and meet the technical requirements needed for approval by Westpac and Mastercard. We were also well aware that when building a payments product, there is no room for error and security is a key priority. So we designed 3 levels of security that customers could choose from, allowed them to select and add multiple cards at once, and created a full-screen UI takeover during the payment process providing real-time status of the payment or errors.

The Result

The app went live in the Android PlayStore, quickly earning positive reviews from users. Westpac team members who regularly use Android Pay and Apple Pay report that they prefer the look of Westpac Pay, and find the experience more interactive.

“Roam’s technical knowledge of the Android system and the tooling was excellent. That wasn’t just about developing, but actually supporting and getting builds out the door, with analytics and customers experience all done. That was one of the biggest appeals.”

- Grant Dowman,

Technical Owner, Westpac

/Next Client Story

eBay

Reimagining Sweden’s biggest online marketplace as a mobile-first experience.