/Client Story

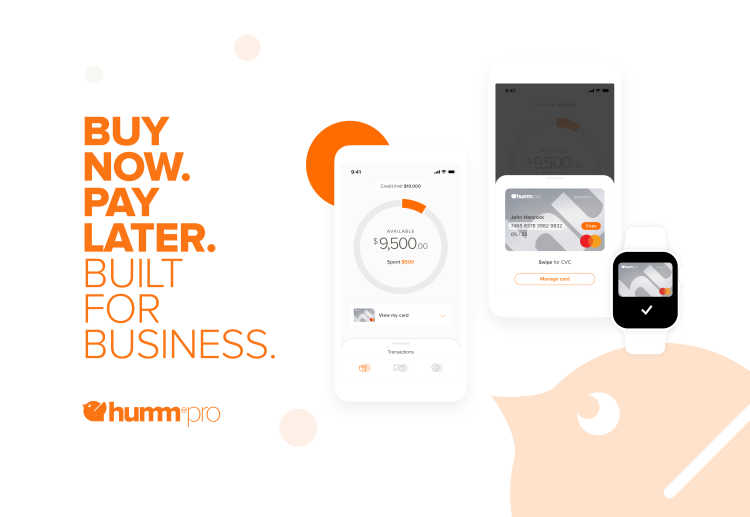

hummpro

Creating a big tool for small businesses.

A leading payment product for business users.

- 01Handled the product design and development of a BNPL product platform in Australia and New Zealand

- 02Provided secure banking and digital payment integrations

- 03Created a comprehensive design system to support a fresh, digital-first design

Services

Client

hummgroupIndustry

The Challenge

Buy Now Pay Later (BNPL) solutions are rapidly gaining popularity among consumers around the world, and humm®group has been at the forefront of providing BNPL solutions in Australia and New Zealand. Following the success of their existing portfolio of payment products (humm®, bundll® and humm®90), hummgroup decided to bring the benefits of BNPL to a new audience: owners of small and medium-sized businesses.

The Solution

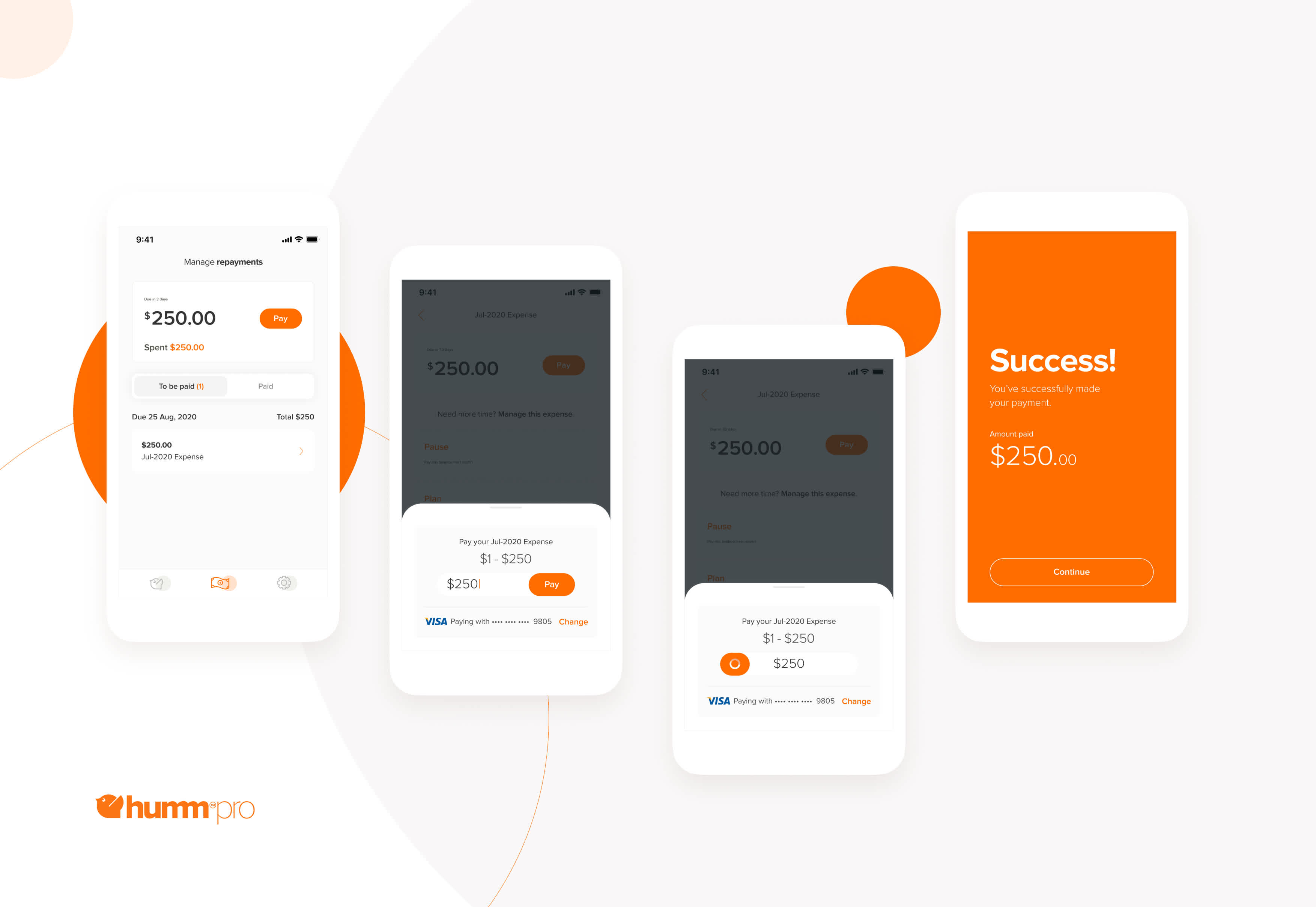

We were engaged by hummgroup to help design and develop humm®pro, a BNPL solution for business owners. Through the hummpro app for iOS and Android, business owners can apply for a credit limit of up to $30,000 that they can spend and repay over time. The app provides a great deal of flexibility, including allowing users to delay their payment due date or split payments into installments over 12 months. Across both the onboarding process and the core product, we provided UX and UI design, journey mapping, frontend development, backend support and mobile development on iOS and Android.

Having worked with hummgroup in the past to help develop bundll and humm, the project kickoff was quick and easy, given our familiarity with their processes and ways of working. hummgroup already had key features in mind for hummpro when we were brought onboard, including 0% interest rates, minimal fees and the ability to pause and roll over payments. We conducted user interviews during the discovery phase to get a clearer picture of how these features might resonate with the target audience. This set a clear initial direction for the product strategy, allowing us to jump right into technical and design considerations. We conducted workshops with the hummgroup team to shape the initial visual design, which was also informed by high-level mockups created by a third-party branding agency.

This design was further refined following intensive user research. Based on the results of our user interviews and testing, we updated the design to make it more fresh, modern, and digital-friendly. It was updated again following the hummgroup rebrand, bringing it in line with the other products across the hummgroup portfolio while still allowing it to stand out as its own distinctive product.

We created a complete design system to facilitate the easy implementation of this new design across hummpro, in terms of both core product and all associated branded content. Our product, design and development teams collaborated to ensure a balance of feasibility and desirability.

The development process involved overcoming the challenge of collecting user data in a way that balanced the need for speed, ease of use and privacy with the need for security and identity verification. Seamless integration with Google Pay and Apple Pay was an early priority, since it would be essential for users to make payments easily. We also needed to ensure secure integration with traditional bank accounts so that users could link their accounts and debit and credit cards for repayment.

Given the sensitive nature of financial services products and the potential for fraudulent use, security was a major concern. hummpro incorporates multiple layers of security. hummgroup chose Auth0 as their company-wide identity provider, with hummpro being the first product to integrate with it. We worked closely with the Auth0 team to implement the web component that allows user identity verification to happen within the hummpro app. Additionally, the app employs anti-fraud libraries, including SecureBank, to monitor user behaviour inside the app and detect fraudulent users attempting to create multiple accounts. Information never comes back from a single endpoint, and users are required to enter their password or biometric verification before viewing their hummpro card within the app.

Penetration tests carried out by a third party found no vulnerabilities; however, security continues to be a core concern as hummpro’s user base increases and the app evolves.

The Result

hummpro soft-launched in December 2020 in New Zealand and Australia as initially planned, giving business owners and operators in both markets the chance to take control of their finances with seamless digital spending and flexible repayments.

/Next Client Story

Backr

A platform supporting Australian entrepreneurship.