/Client Story

Bundll

Partnering with hummgroup and Mastercard to launch a new BNPL solution in Australia.

A next-generation BNPL platform

- 01Developed a new mobile payment experience

- 02Provided ongoing support for humm group's fraud mitigation efforts

- 03Launched several additional key features since launch

- 04Boosted the app’s profitability through paid features

Services

Client

hummgroupIndustry

The Challenge

Millennials are famously credit-averse, making them a difficult market to tap into for many traditional financial players. By serving the same purpose as a credit line but without the spectre of interest, buy now, pay later (BNPL) has emerged as a key point of entry for financial institutions looking to reach Millennial customers. humm®group partnered with Mastercard to break into the Australian BNPL market with a mobile payment experience for iOS and Android named bundll®.

The Solution

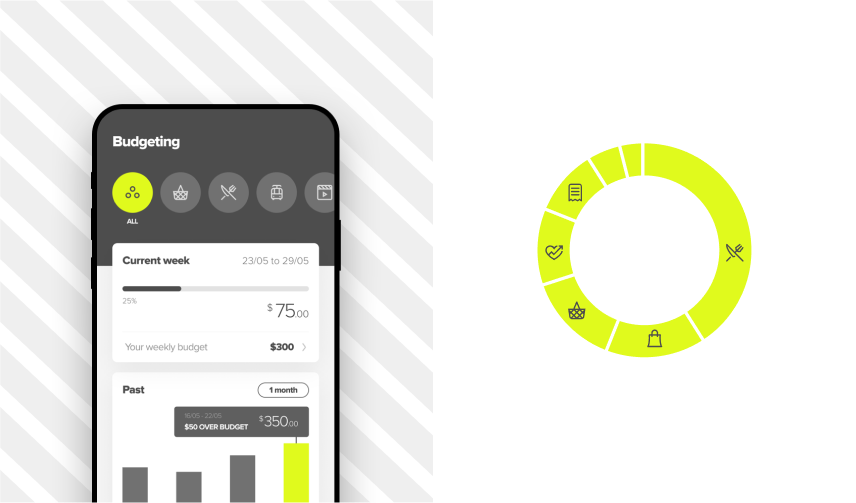

bundll gives users a virtual card to use in their Apple or Google Pay wallet to shop at any online or retail outlet that accepts Mastercard. Purchases over the period of a week are bundled into a single amount that can be paid off after a certain amount of time, interest-free. This provides an advantage over a traditional BNPL transaction that requires both a merchant and customer to be signed up to the same service.

hummgroup partnered with us to build bundll. Our broad, cross-industry experience in building unique mobile apps meant that we already had the necessary toolkits and processes in place to build a product of bundll’s size and complexity. We quickly ramped up a large product team, including designers and developers, to take on the product build and deliver within a tight timeline.

We ensured that the backend architecture could accommodate multiple dependencies and moving parts, all of which needed to communicate with each other successfully during the onboarding process and day-to-day operation of a user’s bundll account. We were able to deploy our existing mobile framework and development practices for bundll, and run at a high development speed in order to roll out functionality screen-by-screen. bundll launched a mere 4 months after we first took on the project, and our focus shifted to supporting hummgroup’s fraud mitigation efforts. As with any financial services product, bundll is a target for fraud attempts, requiring constant improvement and vigilance to ensure a secure experience for users.

Our secondary focus is on continuous improvement in bundll's offering, mainly through the rollout of the app’s paid features, Paid Snooze and superbundll. bundll users are given a free Snooze that they can use to give themselves more time to pay; Paid Snooze allows additional Snooze periods. superbundll collates multiple bundlls for a flat fee, unlocking a higher limit and longer to pay.

The Results

Since bundll’s launch in February 2020, there have been nearly 20 app releases pushed out to the stores for each platform. Multiple key features have also been added, including the bundll shop, superbundll, Paid Snooze, profile editing and ID scanning. The userbase is set to grow with the rollout of additional features, increased brand awareness and the booming popularity of BNPL in Australia.

/Next Client Story

Goodnature Chirp

A connected platform to protect native plants and wildlife.